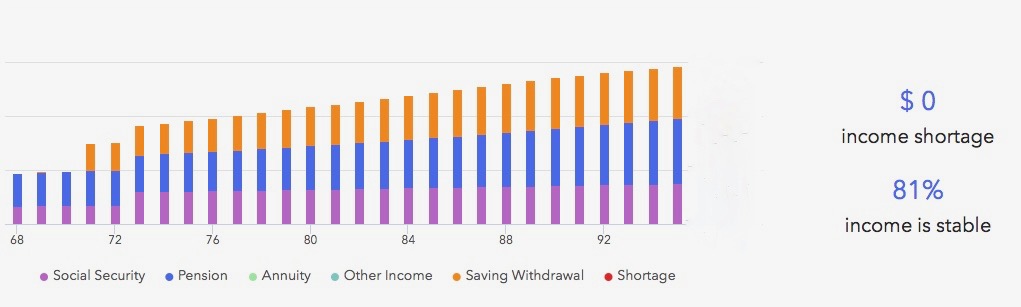

The number one concern of retirees today is the possibility of outliving their money.

Nowadays, people are living longer than ever before. It’s important to partner with a team that recognizes the structural differences of life phases; accumulation vs distribution. Proper income planning can help you feel more confident your money will be there when you need it.