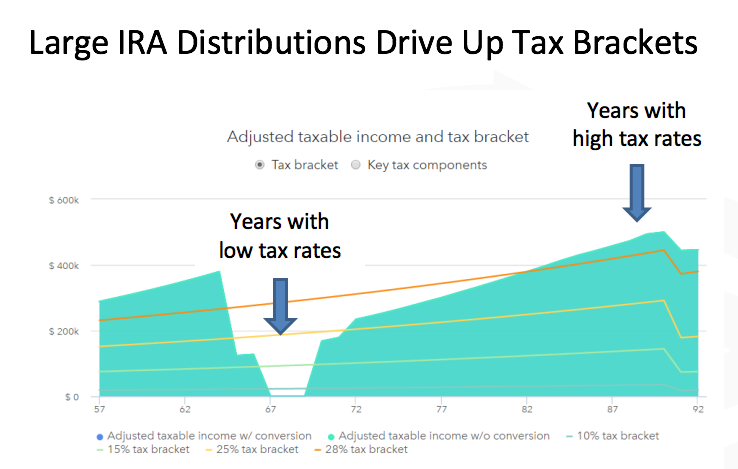

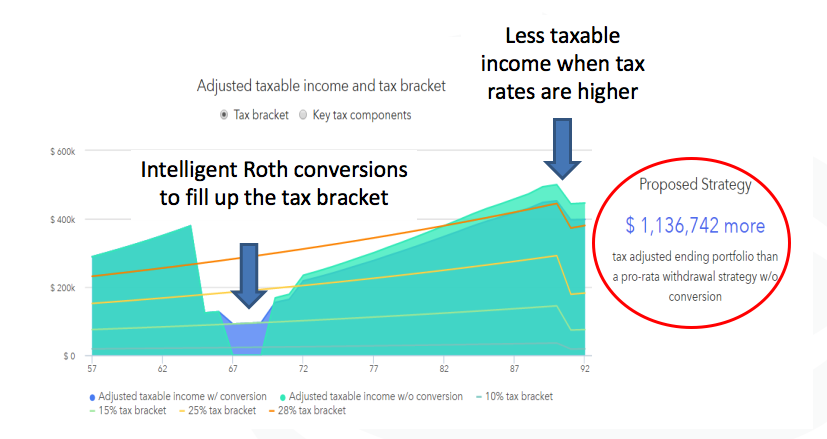

Is Uncle Sam destined to be an ever increasing partner with you in retirement? Longevity challenges, market risk, and inflation are not the only headwinds Americans face today.

The reality is, most pre-retirees and retirees have most of their savings in tax-deferred accounts ( traditional IRA, 401k, 403(b) etc) that will be taxed at ordinary income tax rates upon distribution. Higher future tax rates can erode wealth in a big way. By scheduling appropriate contributions and distributions from tax-favored retirement plans we can help you minimize the tax impact of your financial decisions.